Daily Digest #01: Modeling life, underatanding power and Gautam Baid talk

Date: 2024-04-22

Modeling life, underatanding power and Gautam Baid talk

1.Modeling Life: Oscillation

Bullet points:

• Oscillatory behavior refers to a cyclical system behavior that occurs in the human body.

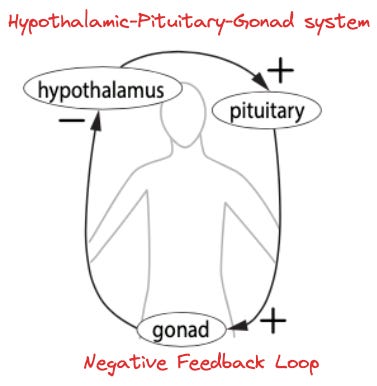

• The hypothalamus (H), pituitary gland (P), and gonads (G) are involved in a hormonal feedback loop.

• There is a negative feedback loop where increased gonadal hormones inhibit hypothalamus hormones.

• This HPG axis can be modeled using differential equations with sigmoid functions.

• Oscillations arise from time delays in the feedback loop and steep negative feedback curves.

2. Gautam Baid: The Making of a Value Investor

My five key takeaways:

-

Investment Philosophy and Background: Gotham Bade discusses his transition from a high-paying job in investment banking to pursuing his passion for the stock market. Despite initial rejections and financial challenges, his persistence led him to secure a significant role in investment management, highlighting the importance of resilience and dedication in career shifts.

-

Learning from Losses: Early in his investment journey, Bade made costly mistakes by investing without considering valuations or business models, leading to significant financial losses. These experiences taught him the critical importance of due diligence and understanding underlying business fundamentals before investing.

-

Strategies for Long-term Investment: The investment approach Bade advocates is built on “variant perception” and long-term structural trends. This method involves identifying and investing in businesses at inflection points where the market undervalues their growth potential, thus potentially yielding high returns as these businesses evolve.

-

Psychological Resilience: Bade emphasizes the psychological aspects of investing, particularly the necessity of detaching from daily stock price movements and focusing on long-term business performance. He also discusses the utility of maintaining an investment journal to learn from past decisions and avoid repeating mistakes.

-

Navigating Market Cycles: Bade shares insights on managing investments during market volatility. He discusses his strategy during the COVID-19 market crash and the importance of investing in quality businesses that can withstand economic downturns, thereby illustrating how a focus on solid fundamentals can provide stability and growth even in challenging times.

3. Charlie Munger on his regrets of not becoming a trillionaire during his last interview

4. Understanding Power

Footnotes for the book UNDERSTANDING POWER THE INDISPENSABLE CHOMSKY

Aaron Swartz Wrote The Book That Changed My Life.

5. Steal Like An Artist

Related Article

👉Daily Digest #02: The minimalist entrepreneur Course, RBS and VIC